Page 48 - ECU_Annual_Report_2018

P. 48

EASTERN CREDIT UNION Annual Report 2018

In accordance with the loan approval policy for the Society and in the interest of expediency and service delivery,

various tiers of approvals were in effect and as such, the number of files seen by the Committee is a mere 1% of

the total applications treated with by the Society.

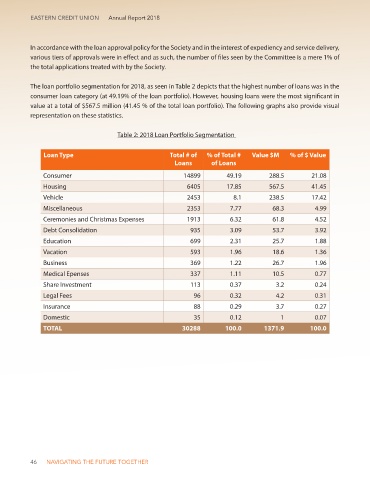

The loan portfolio segmentation for 2018, as seen in Table 2 depicts that the highest number of loans was in the

consumer loan category (at 49.19% of the loan portfolio). However, housing loans were the most significant in

value at a total of $567.5 million (41.45 % of the total loan portfolio). The following graphs also provide visual

representation on these statistics.

Table 2: 2018 Loan Portfolio Segmentation

Loan Type Total # of % of Total # Value $M % of $ Value

Loans of Loans

Consumer 14899 49.19 288.5 21.08

Housing 6405 17.85 567.5 41.45

Vehicle 2453 8.1 238.5 17.42

Miscellaneous 2353 7.77 68.3 4.99

Ceremonies and Christmas Expenses 1913 6.32 61.8 4.52

Debt Consolidation 935 3.09 53.7 3.92

Education 699 2.31 25.7 1.88

Vacation 593 1.96 18.6 1.36

Business 369 1.22 26.7 1.96

Medical Epenses 337 1.11 10.5 0.77

Share Investment 113 0.37 3.2 0.24

Legal Fees 96 0.32 4.2 0.31

Insurance 88 0.29 3.7 0.27

Domestic 35 0.12 1 0.07

TOTAL 30288 100.0 1371.9 100.0

46 NAVIGATING THE FUTURE TOGETHER